1) Company history & Management

Background & milestones :- Rvnl is a Indian government enterprise incorporated in 2003 to fulfill rail infrastructure projects. Over two decades it has produce from a railway project executor into a diversified infrastructure EPC/PMC company with presence across railways, metro, highways, ports and telecom.

Leadership :- As per FY25 divulgence , the Board/KMP list includes Shri Pradeep Gaur (Chairman & MD). Key executive changes in FY25: Shri Abhishek Kumar appointed Director (Finance) and Shri Sandeep Jain appointed Director (Projects), strengthening finance and execution leadership.

Assessment :- The team combines of PSU governance depth with long execution experience in railway EPC/PMC, useful when bidding for large Indian and overseas works. Execution familiarity with Ministry of Railways (MoR) processes and pan-India project management are meaningful pluses.

so this article we are trying to analysis the Rvnl Share Price based on the data like annual reports other websites.

2) Business Model Of Rvnl Share

How RVNL makes money

MoR assigns big rail projects to rvnl. rvnl will act as project manger, building relationship with contractor, supervising the executor to improve in the earning the fixable management fee to build the project cost. rvnl will act the general contractor which is choose by railways.

Competitive bidding

to build more EPC margin rvnl progressively bids more projects than the private companies across rail,metro,highways,ports,manufacturing and telecom.

Example for a 15-year-old:rvnl will be assign if railway lines needed, than rvnl will hire the specialists to lay tracks to build bridges,electrify lines and many more works which is related to railways. for this rvnl will charge the fee for managing and delivering the project.

RVNL can bid, If it wins If a metro depot or a highway package is tendered. it earns an EPC contractor’s margin for building it.

Cost structure & profitability drivers

Major costs are works contracts, materials and site costs rvnl profitability depends on

- project and competitively bid.

- execution speed (turning order book into revenue).

- claim recoveries/escalations.

- working capital discipline.

RVNL’s operating margin is structurally likewise mid,single,digit typically government EPC with PAT margin near by 6% in FY25.

3) Competitive Advantage (Moat)

Institutional trust & relationships As a Navratna PSU with a 20-year track record for MoR RVNL enjoys occupancy and process naturalness valuable in complex multi year rail projects.

Rvnl order book fy25 2025

Independent analysts and rating agencies peg reports RVNL’s FY25 end orderbook at ₹97,000–100,000 crore. offering multi year revenue visibility.

Diversification & bidding capability

CARE Ratings notes the order book’s mix shift about 49% nomination as of 31-Jan-2025, with increasing the share to competitively won the projects. expand addressable markets beyond Railways.

Barriers to entry

Pre qualification in railways and metro, safety and quality track records,PSU governance and site gathering capacity for scattered regulated works.

Moat risks

a narrow margin delays in receivable cycles can short on cash, bid intensity is rising in non railway segments.

4) Future Plans & Growth Prospects

According to management commentary, RVNL is turn to more competitive bidding and international attempt, while retaining core railway execution.

Order pipeline & inflows

Street research post FY25 indicates FY26 order inflow ambition rising to ₹170–180 billions compere to ₹140 billions in FY25. order book near ₹970–980 billions.

Industry growth

India’s railways and metro capital expenditures and broader transport infrastructure remain raised. supporting mid and teens revenue growth potential for capable executors.

Can RVNL outpace industry?

with large scale credential ans diversification of rvnl can track or quietly the outpace sector growth.

- converts order book faster.

- keeps margins stable in competitive bids.

- secure the working capital.

5) Financial Health Of RVNL

(Recent results (FY25 vs FY24)

- Revenue from operations: ₹19,923.2cr.

- PAT: ₹1,282.3cr.

- PAT margin: 6.4%.

Five years trend (consolidated) :Revenue: FY21–FY25 shows growth then a dip in FY25 .

(data series available on Screener)

Cash flows

Operating cash flow was ₹1,878cr in FY25 which is ₹2,956cr FY24.

reflecting working-capital swings typical in EPC.

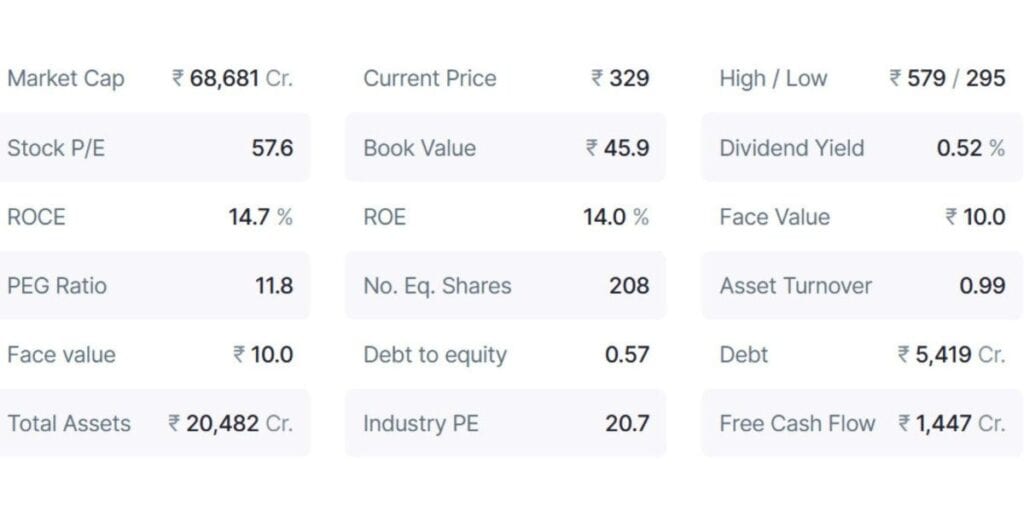

Balance sheet quality

Equity (share capital + reserves) is ₹9,571cr.

Borrowings ₹5,419cr.

implying D/E = 0.57

moderate for an EPC PSU of this scale.

rvnl share price target analysts

6) Valuation Of Rvnl Share Price

(compering to other competitors by current market source)

- RVNL – P/E-57–58, P/B- 7–8.

- IRCON – P/E-24, P/B-2.7.

- RITES – P/E-32, P/B-4.9.

- RailTel – P/E-35, P/B-5.9.

Interpretation

handling the PE&PB RVNL trades a at premium to peer railway PSUs.

- its larger order book/visibility.

- market expectations of sustained growth and diversification

(Disclaimer: This is for educational purposes only, not for investment suggestions).

7) Pros & Cons (Investment View On Rvnl Stock)

Pros

- Deep MoR relationships, two-decade execution record.

- Very large order book.

- Diversification into metro, highways, ports, telecom.

- Moderate leverage with positive operating cash flows.

- Company was been maintaining healthy dividend payout is 29.8%.

- Company median sales growth is 25.8% in last 10 years.

Cons

- Low structural margins in EPC.

- Working-capital risk can pressure cash.

- Bidding intensity rising as nomination share declines.

- Execution/delay risk across multi-agency projects.

- Stock is trading at 7.18 times in it’s book value.

- The company has delivered poor sales growth of 6.52% over last five years.

- Earnings include is other incomes around Rs.1,084 Cr.

- Promoter holding is decreased over past 3 years is -5.36%.

8) Five Years Projections Of Rvnl Share Price

We are trying the predict the rvnl share price target and financial Analysis for the next five years (educated guesses).

What stats we Analysis

in FY2025 RVNL made around ₹19,923cr in revenue and profit ₹1,282cr, Each share earned about ₹6.15 EPS.

Assumptions

(If RVNL keeps growing constantly (about 12% in a year) and maintains its current profit margin (around 6%), we can estimate future numbers).

What are the numbers could look like

| Year | Revenue(cr) | Profit(cr) | EPS |

| FY26 | 22,300 | 1,428 | 6.85 |

| FY27 | 24,992 | 1,599 | 7.67 |

| FY28 | 27,991 | 1,791 | 8.59 |

| FY29 | 31,349 | 2,006 | 9.62 |

| FY30 | 35,111 | 2,247 | 10.78 |

By 2030 the revenue revenue about to ₹35,000cr and profit 2200cr if it growth consistently

Three Scenarios

(Bear case – slower growth, Bull case – faster growth)

- Base Case – 12% growth per year will consider as a stable margins.

- Bear Case – 8% growth will consider as a margins fall a bit or lower profits.

- Bull Case – 16% growth will consider as a higher margins or higher profits.

like same wise HDFC bank have a look on that.

9) Indian or US markets Or Global?

Company & listing – RVNL is an Indian PSU listed on NSE & BSE, equity is traded only in India.

Business footprint – Historically India focused international projects are being pursued to diversify.

Quick data Analysis

FY25

Revenue ₹19,923cr,

PAT ₹1,282cr,

EPS ₹6.15,

Order book ₹97,000–100,000cr.

(Disclaimer – this information provided in the article is only for educational purpose. we are not SEBI Registered financial adviser. do not consider to as investment suggestions or recommendation to buy or sell in shares . Please do your own research or approach the licensed financial advisor before making any investment decisions).

The Sources Base

FY25 & FY24 Annual Reports

screener

Bottom Line

Rvnl offers visibility and diversity backed by PSU credibility credibility and a very large order book. The trade off is thin structural margins and working capital sensitivity. the stock believes continued strong inflows and disciplined execution. For new allocations it prefer accumulating on corrections or evidence of sustained cash flow improvement and stable margins in the more competitive non nomination mix.

What is the target price of RVNL in 2025?

Base Case – 12% growth per year will consider as a stable margins.

Bear Case – 8% growth will consider as a margins fall a bit or lower profits.

Bull Case – 16% growth will consider as a higher margins or higher profits.

Some analysts have issued targets ranging from ₹303 in late 2024 to potential targets of ₹510–₹560 or even ₹700–₹750 by 2025

Is RVNL a government company?

rvnl is a Indian government enterprise incorporated in 2003 to fulfill rail infrastructure projects. Over two decades it has produce from a railway project executor into a diversified infrastructure EPC/PMC company with presence across railways, metro, highways, ports and telecom.