Introduction About RRP Semiconductor

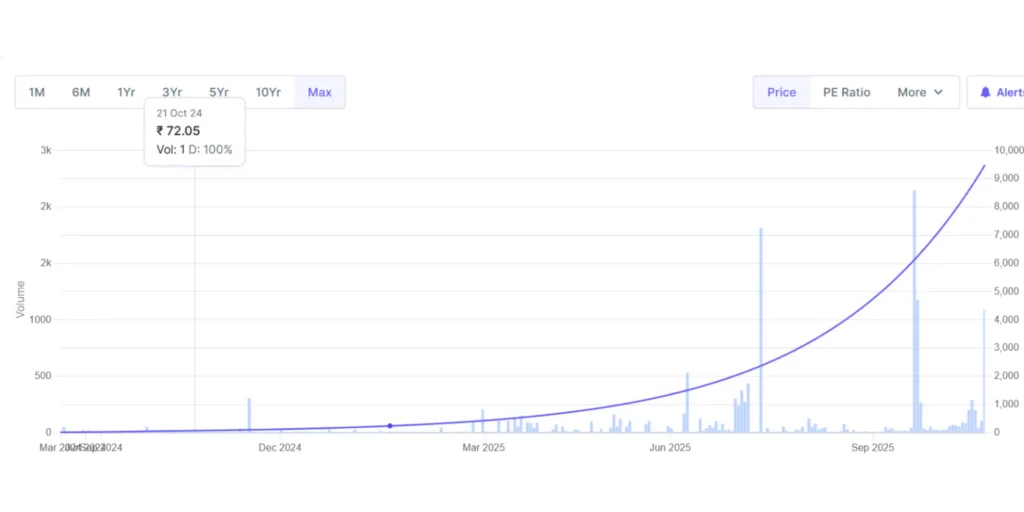

In 2024, 2025 RRP Semiconductor Limited became one of the most discussed penny stocks on – Indian stock market. Its share price skyrocketed from a few hundred rupees to over ₹9,000 within months, gathering the attention of retail investors searching for the next multibagger stock RRP Semiconductor story.

Lets analyze the company’s background, fundamentals and realistic RRP Semiconductor share price target 2030 based on actual financial data and industry trends.

RRP Semiconductor share History and Business Overview

RRP Semiconductor Limited formerly known as G D Trading & Agencies Ltd, is a BSE listed Indian small cap that revolved toward the semiconductor and OSAT (Outsourced Semiconductor Assembly and Testing) industry.

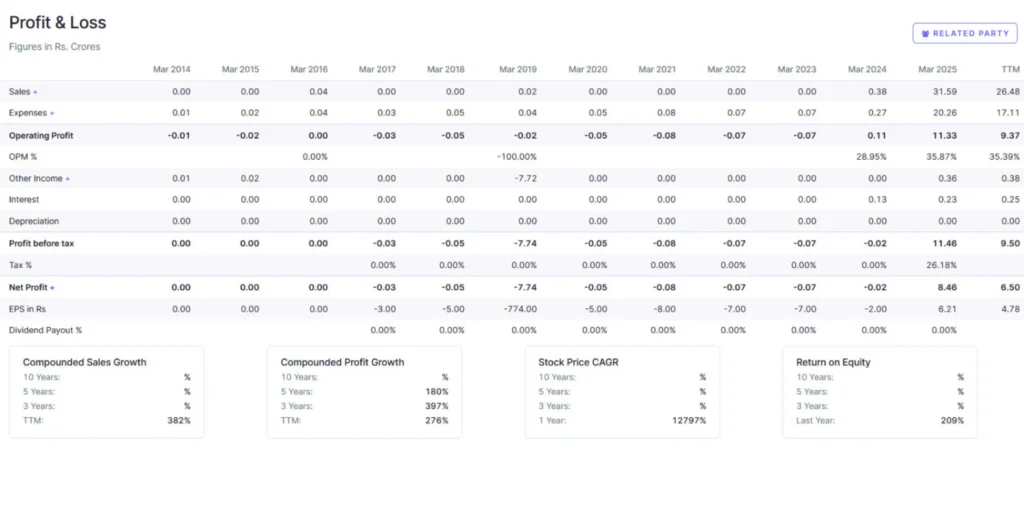

In FY2024, 25 the company financial report

| Financial Metric | FY2024–25 Value |

|---|---|

| Revenue | ₹31.59 crore |

| Profit After Tax (PAT) | ₹8.46 crore |

| Earnings Per Share (EPS) | ₹7.57 |

It also raised ₹16.22 crore through a preferential share issue to fund its OSAT facility setup and technology investments.The company’s management team, led by Mrs. Sumita Mishra and Mr. Ramesh Chandra Mishra aims to position RRP as a homegrown OSAT service provider supporting India’s semiconductor ambitions.

What Does RRP Semiconductor Do?

To understand RRP Semiconductor business imagine a chip that powers your smartphone or electric car. Before chips reach the final device, they need to be packaged, assembled and tested that’s where RRP’s OSAT operations come in.

simple words:

RRP Semiconductor earns money by offering packaging and testing services for semiconductor chips, catering to Indian and potentially global clients.The company has also provided loans to its group entity, RRP Electronics Ltd, to build related infrastructure a move meant to strengthen its ecosystem but also a key financial risk if repayments delay.

RRP Semiconductor Share Price History

| Year | RRP Semiconductor Share Price History |

|---|---|

| 2022 | Traded below ₹100 |

| 2023 | Began rising after the OSAT business announcement |

| 2024–25 | Surged beyond ₹9,000 per share, attracting heavy media and retail attention |

| 2025 (Present) | Trading under BSE’s enhanced surveillance due to abnormal price movement |

RRP Semiconductor Financial Highlights

| Metric | FY2024–25 |

|---|---|

| Revenue | ₹31.59 crore |

| Profit After Tax (PAT) | ₹8.46 crore |

| Earnings Per Share (EPS) | ₹7.57 |

| Total Assets | ₹40.32 crore |

| Equity | ₹16.91 crore |

| Debt / Equity Ratio | 0.71 |

| Trade Receivables | ₹24.15 crore (High) |

| Metric | Value (FY2024–25 ) |

|---|---|

| Market Cap | ₹12,913 Cr |

| Current Price | ₹9,478 |

| High / Low | ₹9,478 / ₹75.0 |

| Stock P/E | 1,987 |

| Book Value | ₹12.0 |

| Dividend Yield | 0.00% |

| ROCE (Return on Capital Employed) | 80.2% |

| ROE (Return on Equity) | 209% |

| Face Value | ₹10.0 |

| PEG Ratio | 5.00 |

| No. of Equity Shares | 1.36 Cr |

| Asset Turnover | 1.55 |

| Debt-to-Equity Ratio | 0.76 |

| Total Debt | ₹12.5 Cr |

| Total Assets | ₹40.3 Cr |

| Industry P/E | 34.6 |

| Free Cash Flow | ₹-18.8 Cr |

| Earnings Per Share (EPS) | ₹4.77 |

LG Electronics Share Price Target 2025

RRP Semiconductor Share Price Target 2025–2030

Based on the company’s growth potential financials,and industry outlook below are projected price ranges under this three scenarios

| Year | EPS Estimate (₹) | Conservative (20 P/E) | Base (50 P/E) | Optimistic (150 P/E) |

|---|---|---|---|---|

| 2025 | 6.8 | ₹136 | ₹340 | ₹1,020 |

| 2026 | 7.1 | ₹142 | ₹356 | ₹1,068 |

| 2027 | 7.5 | ₹151 | ₹378 | ₹1,133 |

| 2028 | 7.8 | ₹156 | ₹390 | ₹1,170 |

| 2029 | 8.0 | ₹160 | ₹400 | ₹1,200 |

| 2030 | 8.1 | ₹162 | ₹406 | ₹1,218 |

RRP Semiconductor Share Price Target

- RRP Semiconductor share price target 2025: ₹136 to ₹1,020.

- RRP Semiconductor share price target 2026: ₹142 to ₹1,068.

- RRP Semiconductor share price target 2027: ₹151 to ₹1,133.

- RRP Semiconductor share price target 2028: ₹156 to ₹1,170.

- RRP Semiconductor share price target 2029: ₹160 to ₹1,200.

- RRP Semiconductor share price target 2030: ₹162 to ₹1,218.

Why RRP Semiconductor Is Multibagger Stock

- Semiconductor boom India’s focus on building chip manufacturing and packaging facilities is a strong tailwind.

- OSAT demand Global OSAT market growing at 8 to 9% CAGR, India wants to local chip assembly.

- Government push Production linked incentives could benefit early players.

- Low debt and expanding capital base Equity infusion strengthens the balance sheet.

Expert Opinion on RRP Semiconductor share

RRP Semiconductor has vision but fundamentals must catch up. The semiconductor theme is strong yet valuations are extended. Only long term investors ready for volatility should track it. then RRP Semiconductor share price target 2030 in the ₹400 to ₹1,200 range is realistic. Otherwise, the stock could correct sharply before any sustainable multibagger rally.

so this article we are trying to analysis the IREDA Share Price Target 2025 based on the data like annual reports other website like screener

Conclusion

RRP Semiconductor is one of the most exciting yet risky micro cap stories in India. The semiconductor narrative gives it a futuristic edge but investors must separate hype from reality.If your a retail investor searching for multibagger stock RRP Semiconductor share target , treat it as a high risk, high reward bet. Track quarterly numbers, BSE announcements and OSAT project execution closely before making decisions.