Introduction

Reliance is one of the largest industrial groups in India, extending businesses from oil to retail. It is considered a top leader in India. Now Reliance is preparing to take another big step with Jio, which has already created an internet revolution in the Indian telecom sector with a valuation of around $154 billion (₹60,000 crore. Reliance Jio will be listing on the stock market. This will be the biggest listing in Indian stock market history.

What Is IPO In Share Market

IPO stands for Initial Public Offering, Every private companies launches an IPO to get listing on the stock market. For this the company releases some of its shares to the public and investors can buy those shares by paying money through the stock market.

Generally companies go public to raise huge amounts of money for purposes for the reason to build a stronger business, entering global markets, repaying debts and increasing their market value. That is why many private companies choose to list on the stock market.

Structure of Reliance Jio IPO

Reliance Chairman Mukesh Ambani announced at the AGM that Reliance aims to make Jio as a global brand and expand its international demand. Jio will be listed on the stock market with an IPO around ₹60,000 crore this move will create history. The Jio IPO is seen as a game changer because Jio is not just another company it has transposed the entire Indian telecom sector.

Today the internet has reached almost every corner of India largely because of Jio. its owned over 75 crore users, Jio has become the foundation of India’s digital economy boom, powering OTT platforms, digital media, UPI and much more.

Jio vs Airtel Which Is Better

1) User base (subscribers)

Reliance Jio roughly 500 million mobile and fixed wireless subscribers making it the largest operator in India.

Bharti Airtel The Bharti Group (India + Africa) serves around 600 million customers in total. In India mobile subscribers are reported in the high 200 million to 300 million range, depending on the metrics used. Airtel reports its consolidated customer base across both India and Africa.

2) Global market comparison (presence & market cap / footprint)

Jio Reliance Jio primary footprint is in India but its parent company Reliance Industries is pushing for global expansion and a planned IPO. Reliance is a massive combination and the consolidated RIL group generates substantial revenues and cash flows that support Jio growth.

Bharti Airtel operates across India, Africa, Bangladesh and Sri Lanka. Airtel Africa is a separately listed business with its own market capitalization, holding a significant presence in multiple African markets. Airtel consolidated reporting includes strong Africa numbers giving it a genuine multi country footprint.

3) Average recharge rates / ARPU (Average Revenue Per User)

Industry context (India) Wireless ARPU across India recently reached around ₹186–₹187 overall with prepaid data consumption rising to about 24 GB per month.

Operator ARPUs (quarterly) In the most recent quarterly reports, Jio’s ARPU stood at around ₹208–₹209, where else Airtel’s ARPU was in the range of ₹245–₹250. This highlights that Airtel earns more per user on average whereas Jio maintains a much larger scale of subscribers.

4) Revenue Comparing Jio And Airtel

Reliance Jio (group context): Reliance Industries FY2024-25 consolidated highlights show very large group revenues Jio Platforms reported strong revenue EBITDA growth in FY25 presentations.

Bharti Airtel: Airtel reported FY25 consolidated revenue of ₹1.25 lakh crore which is growth 18% in FY25 and said it reached record revenue market share in mobility.

5) Net profits

Reliance / Jio: Jio Platforms reported materially positive PAT RIL FY25 consolidated PAT and Jio Platforms PAT are public in RIL filings.

Bharti Airtel: reported consolidated net profit (quarter) Q1 FY26 net profit ₹5,948 crore and Q4/FY25 reported adjusted PAT and other quarterly profit figures in its investor releases. Annual adjusted PAT figures are in the Airtel integrated report.

Jio IPO Price, Valuation & Fundraising

Jio has established itself as a strong brand and because of that name recognition. investors are showing more interest in its IPO. Even a modest 5% stake weakening in Reliance Jio could raise between ₹58,000 crore to ₹67,500 crore which is more than double the ₹27,870 crore raised by Hyundai Motor India’s record setting IPO in October 2024. Jio’s valuation stands at up to $154 billion or about ₹13.5 lakh crore.

Reliance Jio IPO Launch Date

The Jio IPO is larger than most other IPOs which is why it will take more time to launch. jio ipo date was not fixed, Its listing has been postponed to the first half of next year. The pre IPO process has already begun. This means that before the official issue, companies usually sell some of their shares to major investors like high profile individuals and private equity firms. This step helps to create trust and confidence among the public about the company and its IPO.

Key Facts About Jio IPO

Reliance is the Parent Company

Reliance Industries is heavily dependent on the oil market and with oil prices fluctuating due to factors such as U.S. tariffs, investors who are focused only on Jio may feel that impact. However Reliance’s other businesses are not directly tied to Jio’s performance Jio’s results depend mainly on its own business numbers.

User Base And Revenue

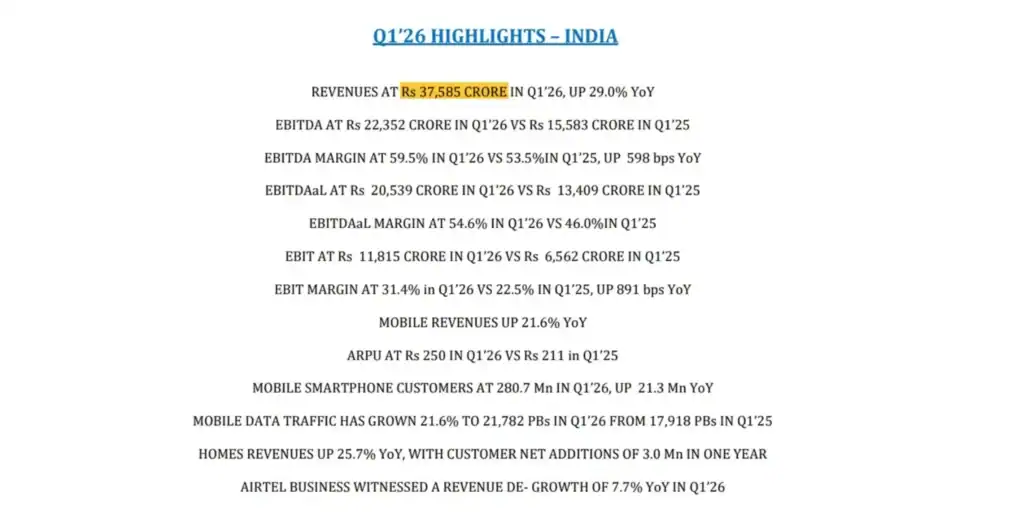

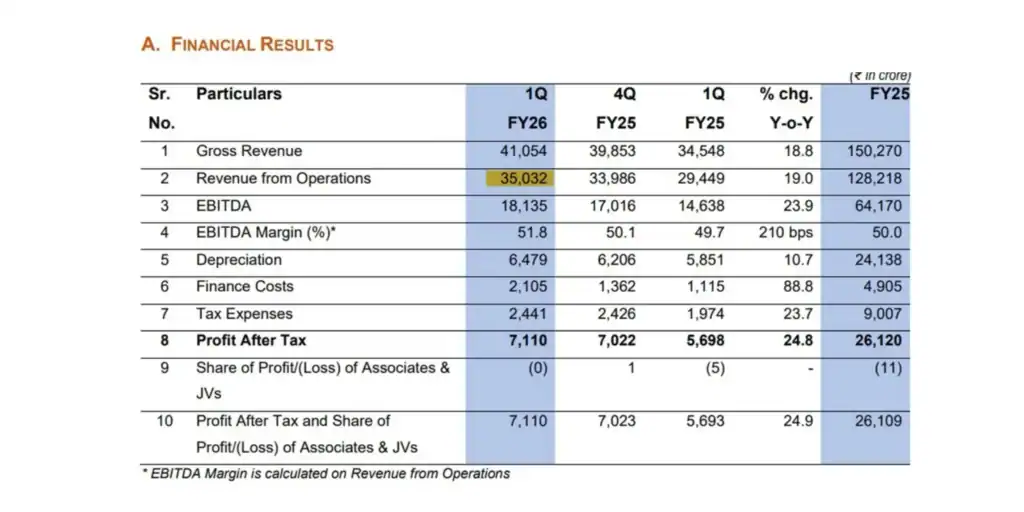

Jio currently holds around 39% market share with the largest user base. However Airtel generates more revenue than Jio. In the second quarter Airtel reported revenue of ₹37,585 crore, while Jio reported ₹35,032 crore, creating a difference of about ₹2,500 crore in favor of Airtel.

Profit Margins (EBITDA)

Airtel’s EBITDA margin stands at 59%, compared to Jio’s 51.8%, showing Airtel’s stronger profitability.

ARPU (Average Revenue Per User)

In Q1 2026, Airtel reported an ARPU of ₹250, while Jio’s ARPU was ₹208. This indicates that Airtel earns more per customer on average maintaining a premium over Jio. To overcome this gap Jio requires additional investments, which is one of the reasons Reliance is planning the upcoming Jio IPO.

Rvnl Share Price Target can aslo read this

The Sources Base

angelone

Conclusion

Usually, Reliance Industries depends mainly on oil with about 50% of its revenue coming from it. However the world is moving towards renewable energy and Reliance Industries is also adopting this shift, though it will take more time to see results. Before that the Jio IPO listing is very important for Reliance to diversify its business. For this reason Reliance has tied up with several companies around the world such as the Meta deal worth ₹855 crore for AI development, a data center established with Google, and recently the launch of Reliance AI Intelligence.

Is Jio coming with IPO?

Reliance Chairman Mukesh Ambani announced at the AGM that Reliance aims to make Jio as a global brand So Reliance Jio Will Be Launch IPO.

Reliance Jio IPO date

The Jio IPO is larger than most other IPOs which is why it will take more time to launch. jio ipo date was not fixed, Its listing has been postponed to the first half of next year.