1. Company History and Management

History : HDFC Bank was incorporated in the year 1994 and became India’s first private sector bank.

Over the three decades, it has grown into India’s largest private sector bank by it’s market capitalization and one of the most valuable bank in the globally.

A key milestone was the 2023 merger with HDFC Ltd. creating a universal bank with strong retail lending,housing finance and deposit franchise.

Management : MD&CEO : Mr. Sashidhar Jagdishan – with HDFC Bank since 1996,became CEO in Oct 2020. Widely respected for execution discipline.

CFO: Mr. Srinivasan Vaidyanathan – seasoned banker,strong track record in financial risk management.

Board includes industry veterans like Kaizad Bharucha (Executive Director) and Renu Karnad (HDFC Ltd. legacy).

Assessment : Management credibility is high. They have consistently delivered growth with stable asset quality,which sets them apart from peers.

2. HDFC Bank Business Model

How it makes money : Deposits – savings/current accounts, fixed deposits → loans home loans,car loans,personal loans,SME and corporate loans. Earns money by charging borrowers a higher interest rate than what it pays depositors Net Interest Income. Also earns from fees from credit cards, payments, Forex, wealth management, distribution of insurance/mutual funds.

Example for a 15-year-old Imagine you give ₹1000 to HDFC Bank as a deposit and they pay you ₹3 interest. They lend your ₹1000 to someone else at ₹8 interest. The difference (₹5) is their profit margin. Add credit card fees, transaction charges, and investment services are extra revenue streams.

Cost structure : Key costs – interest paid on deposits, employee costs, branch/technology expansion, regulatory provisions for bad loans. Profitability depends on (NIM) Net Interest Margin , cost of funds & asset quality.

3. Competitive Advantage (Moat)

Low-cost deposit franchise (CASA ratio high) : A large share of current/savings accounts means cheap funding.

* Scale & Distribution : Over 8,000+ branches added aggressively.

* Pristine asset quality : NPA remain among the lowest in Indian banking.

* Technology leadership : Heavy investments in digital banking, payment platforms,

and fintech tie-ups.

* Barriers to entry : Regulatory requirements, high trust, and scale advantage make

it difficult for new entrants to replicate.

4. Future Plans and Growth Prospects

Focusing on CD ratio(credit-deposit ratio).

post-merger (brought down from 110% to 95%), Expect loan growth to align with system growth in FY26 and outpace it in FY27. Technology roll outs are underway to boost productivity and customer experience.

Industry outlook : The Indian banking sector is is expected to grow at 10–12% CAGR driven by housing finance, digital payments, and SME lending. HDFC Bank is is well-placed to outpace industry growth due to its its scale, technology,and trust advantage.

5. Financial Health

Stock Price of Hdfc Bank depends on financial health

(Recent HDFC Bank Performance by FY2 & Q1 FY26)

* Deposit growth : 16% year on year.

* Advances growth : 7–8% year on year.

* NIMs : Stable despite liquidity pressures.

* Asset quality : Remains strong; NPAs at sector-low levels.

* Costs : Tight leash 7% YoY growth.

* Balance Sheet : Strong capital adequacy,diversified assets,manageable liabilities.

* Cash Flow : Robust operating cash inflows from lending or fees.

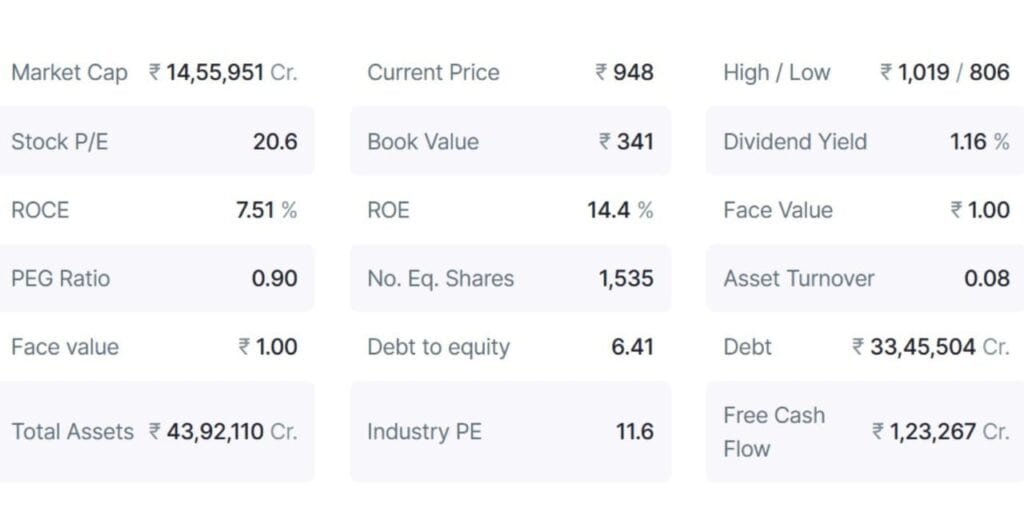

6. Valuation (Ratios Of HDFC Bank Share)

Ratios (approx.. FY25)

P/E: 18–20x

P/B: 2.2x

ROE: 16–17%

Relative to peers : HDFC trades at a premium to ICICI/Axis due to consistent execution but at a discount to its own historical multiples (post-merger digestion).

Currently appears fairly valued to slightly undervalued for long-term investors.

7. Pros and Cons

- Pros

* Largest private bank in India with dominant deposit and loan market share.

* Strong management,governance and asset quality

* Multiple revenue engines (retail, corporate, housing, fee income).

* Positioned to benefit from India’s long-term credit growth.

- Cons :

* Merger integration challenges with HDFC Ltd. are are still playing out.

* Near-term pressure on margins and CD ratio adjustment.

* RBI regulations & interest rate cycles

* Increasing competition from UPI apps and digital first banks.

8. Five Years Financial Projections

Explore detailed insights

* GDP growth is 6.5%, and5%, and credit growth is 11%.

* HDFC Bank loan growth is industry 2% from FY27 onward.

* NIM is 3.8–4.0% and cost to income ,income gradually improves with tech.

* Credit costs remain stable (1%).

9. HDFC Bank Share Price Target Or Forecasts

HDFC Bank Share Price Target depends on this below stats .

| Year | Revenue | Net Profit | EPS Growth |

| FY-26 | 2,10,000 | 52,000 | 12% |

| FY-27 | 2,40,000 | 61,000 | 17% |

| FY-28 | 2,75,000 | 72,000 | 18% |

| FY-29 | 315,000 | 86,000 | : 19% |

| FY-30 | 3,60,000 | 1,02,000 | 18% |

(source:: annual report)

10. Market Presence—Indian, US, or Global?

- Primary market : India core retail & corporate banking.

- Global presence : Limited international branches in Bahrain, Dubai, Hong Kong, etc., but not a major global player. Stock listing: NSE & BSE (India). ADRs also trade in the US (NYSE: HDB). So effectively, an Indian bank with selective global presence.

11. Conclusion

HDFC Bank remains a core long term holding for investors at India’s financial growth story. Moat strength,scale and management quality ensure sustainable growth. short term challenges merger digestion,CD ratio adjustment may weigh on valuations,but these create a buy in dips opportunity.

Over 5 years, HDFC Bank is likely to deliver industry-growth,maintain superior asset quality, and reward to shareholders with strong EPS compounding.

(Disclaimer – this information provided in the article is for only educational purposes. I am not SEBI Registered financial adviser. do not consider to this as investment suggestions or recommendation to buy or sell in shares . Please do your own research on this or approach the licensed financial advisor before making any investment decisions.)