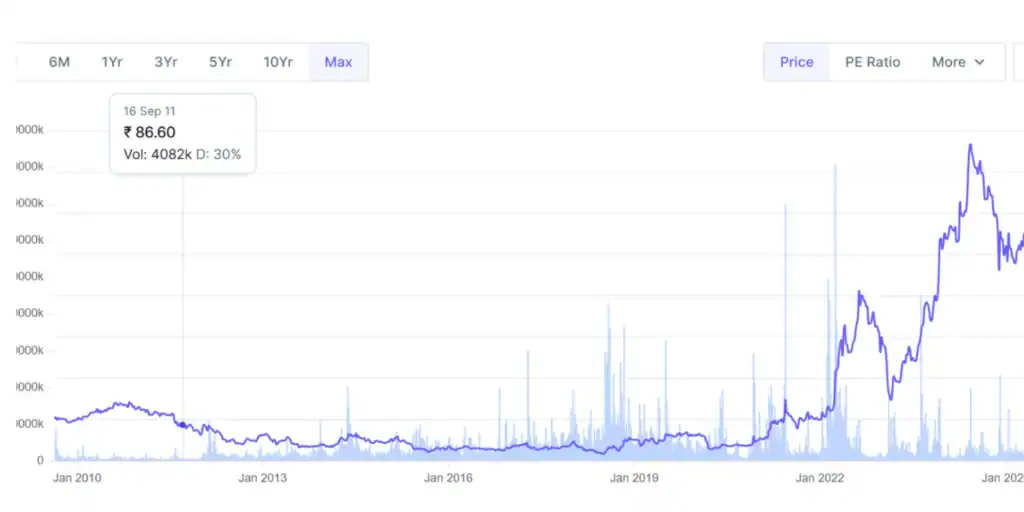

The Adani Power share has become one of the most closely watched stocks in the Indian energy sector. With strong earnings growth, large expansion plans, and improving financial health. investors are showing more interest to know whether the rally in company can continue. In this article we are trying to break down the Adani Power Share Price Target,history, business model, financial performance, and provide insights into Is It a Good Buy Now? the Adani Power share price today and long Adani Power share long term target.

Adani Power Share Background and Management

Adani Power Limited part of the Adani Group which is India’s largest private thermal power producer. it was stated in 2006 and its first plant was Mundra, the company was expanded rapidly to a consolidated capacity of nearly 17.6 GW.

The board management of the company led by MD Anil Sardana and CEO S. B. Khyalia who has decades of experience in the power sector. Their execution track record mainly in bringing projects online on schedule adds credibility to the company’s growth story.

What is Adani Power Share Business Model

The company generates electricity using coal based thermal power plants. company earns revenue by selling electricity to state distribution small companies under long term contracts in the merchant market.

For example

one plant produces 1 million units of electricity in the month and it sells at ₹4 per unit the revenue around ₹40 lakh and Costs mainly buying the raw materials like coal, logistics operations and interest payments. in simple meaning company makes electricity and sell.

Competitive Edge of Adani Power Share

| Competitive Edge | ||||

| Scale advantage | 17.6 GW capacity across India | |||

| Fuel security | Long-term coal contracts and logistics integration | |||

| Revenue stability | Around 87% of capacity under long/medium-term PPAs | |||

| Operational excellence | Consistently high PLFs (71% in FY25) and plant availability (~91%) | |||

Read more about IREDA Share Price Target

Financial Health of Adani Power Share

In the past five years company revenue has grown from ₹28,150 crore in FY21 to ₹58,906 crore in FY25. Profit after tax was jumped from ₹1,270 crore in FY21 to ₹12,750 crore in FY25.

Debt levels remain outstanding at ₹38,335 crore, but leverage has improved and operating cash flows showing very strong. This improvement has attractive the positive side investor sentiment around the company.

| Financials (₹ cr) | FY21 | FY22 | FY23 | FY24 | FY25 |

|---|---|---|---|---|---|

| Revenue | 28,150 | 31,686 | 43,041 | 60,281 | 58,906 |

| EBITDA | 10,597 | 13,789 | 14,312 | 28,111 | 24,008 |

| PAT | 1,270 | 4,912 | 10,727 | 20,829 | 12,750 |

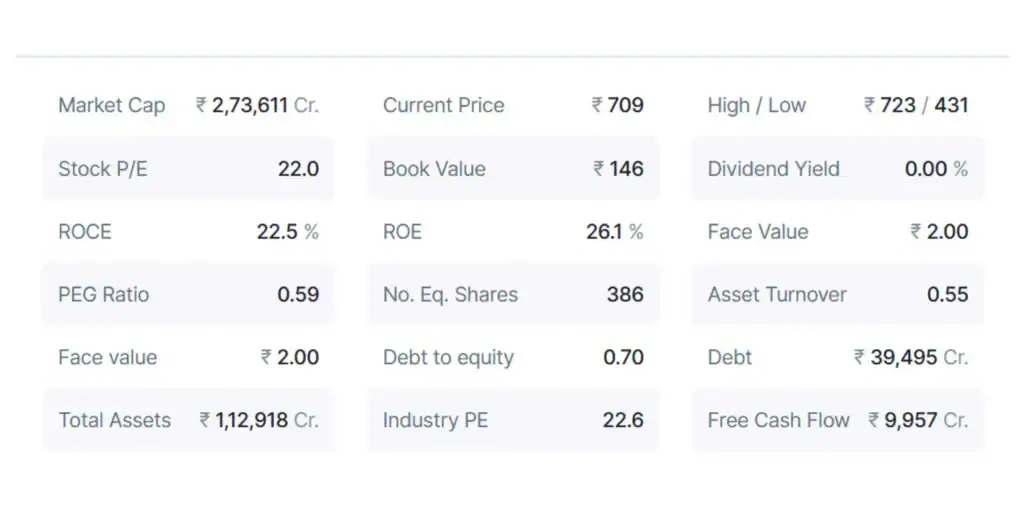

Key ratios of Adani Power share price

| Metric | FY25 | Notes / Insights |

|---|---|---|

| PLF | 71% | Indicates high operational efficiency |

| EBITDA Margin | 41% | Strong profitability |

| PAT Margin | 22% | Healthy net profit margin |

| Gross Debt / Continuing EBITDA | 1.78 | Improved leverage vs FY21 |

| Net Debt | ₹31,023 Cr | Reflects a structurally stronger balance sheet vs 2021 |

Adani Power Share Price Today

As of September 2025 the Adani Power share price today trades around ₹709. This reflects a around 22 P/E (price to earnings ratio) and 4.7 P/B (price to book ratio). valuations that are higher than the broader energy index where else within the line in Indian utility peers.

Adani Power Share Price Target 2025–2030

by top Analysts expectations for the Adani Power share price target depend on execution its expanding in existing power plant and stability in coal costs. Based on projected earnings growth of 8% annually, the company’s EPS could rise from ₹32 in FY25 to and ₹49 in FY30.If the P/E ratio remains in the range of 20–22 this indicates a potential the company share price target of ₹1,000+ by FY30. However, faster renewable adoption, higher coal prices and regulatory risks could slow in the direction.

in below table shows the Adani Power share price target assumption

| Year | Revenue (₹ Crore) | EBITDA (₹ Crore) | Net Profit (₹ Crore) | EPS (₹) | Expected Adani Power Share Price Target (₹) |

|---|

| FY25 (Actual) | 58,906 | 24,008 | 12,750 | 32.32 | ₹709 (Adani Power share price today) |

| FY26 (Projected) | 63,619 | 26,084 | 13,996 | 36.29 | 800+ |

| FY27 (Projected) | 68,708 | 28,170 | 15,116 | 39.19 | 860+ |

| FY28 (Projected) | 74,205 | 30,424 | 16,325 | 42.33 | 920+ |

| FY29 (Projected) | 80,141 | 32,859 | 17,631 | 45.73 | 970+ |

| FY30 (Projected) | 86,512 | 35,419 | 19,055 | 49.42 | 1,000+ |

Pros and Cons for Investors

Strengths Adani Power share

- India’s largest private thermal power producer

- High PPA coverage ensures revenue stability

- Strong operational track record and cash flow generation

- Company has delivered good profit growth 65.7% CAGR over last 5 years

- Company has a good return on equity (ROE) over last 3 Years ROE 40.4%

Risks Adani Power share

- Exposure to volatile imported coal prices

- Rising competition from renewable energy and battery storage

- Regulatory and counterparty risks with state DISCOMs

- company is reporting repeated profits but not paying out dividend

in this article we are trying to analysis the company based on the data from annual reports other websites like screener

(Disclaimer – this information provided in the article is for only educational purposes. I am not SEBI Registered financial adviser. do not consider to this as investment suggestions or recommendation to buy or sell in shares . Please do your own research on this or approach the licensed financial advisor before making any investment decisions).

Conclusion

The company has delivered a strong returns in the recent years, backed by improved financials and progressive expansion plans. While the Adani Power share price reflects hopefulness the investors should track the coal prices, renewable energy trends, and regulatory updates. For long-term investors comfortable with the risks, the stock offers growth potential with a reasonable Adani Power share price target pointing higher over the next five years.