1) Introduction About IREDA

IREDA full form is Indian Renewable Energy Development Agency Ltd, this is a government owned company. India focused on renewable energy Investor that has grown rapidly over FY21–FY25 in loan book from ₹27,854cr to ₹76,282cr. FY25 was a record year highest disbursements and PAT.

Strengths: government has ownership 75%, Navratna status, strong International capital inflow relationships and improving asset quality.

Key risks: higher leverage in FY24, rising gross NPA in FY25 vs FY24 and exposure to project finance Market fluctuations.

Valuation IREDA trades at a materially higher P/E than long time power financiers (REC/PFC).

so this article we are trying to analysis the IREDA Share Price Target 2025 based on the data like annual reports other websites.

2) Company History & Management

Establishment : IREDA is a Government of India finance company created to promote, develop and extend financial assistance for renewable energy projects. It was incorporation year 1987.

Recent milestones : IPO & listing Nov 29, 2023, rise to ‘Navratna’ status strong FY25 performance with Navratna recognition and first issue of Perpetual Debt Instruments in FY25.

Management credibility:

Executive Chairman & MD is Pradip Kumar Das, Finance Director Dr. Bijay Kumar Mohanty. management/board oriented to capital raising and tie ups with multilateral lenders like WB, ADB, JICA etc. Company has independent auditors and clear corporate governance certificates in the annual report. Management has executed aggressive growth and capital raising while maintaining CRAR above regulatory floors.

3) What is The Business Model Of IREDA

What IREDA does: it’s like a specialized bank for clean energy projects. IREDA lends money to builders or operators of solar, wind, hydro, ethanol, biomass, EV charging and green hydrogen projects. They charge interest on those loans and collect fees for arranging finance. for example company lends ₹100 to build a solar park to gets ₹2 interest over years that interest + fees = IREDA’s revenue.

Revenue streams: mainly interest income on loans (core), plus fees & commission, fair value gains or losses on hedges and small other operating income (e.g., solar plant sale power). FY25 interest income was ₹6,575cr majority of total income.

IREDA drivers of profit or Cost structure

Largest cost: finance cost (interest paid to bondholders, banks and ECBs). FY25 finance cost ₹4,141cr.

Credit costs: rose variably but controlled FY25 Asset write down on financial instruments ₹237cr. Operating costs (staff & admin) are modest vs interest items.

Simply What Is IREDA: It’s a lender revenue grows when the loan book grows and when net interest spread is healthy. If you understand how a bank makes money, you understand the IREDA.

4) Competitive Advantage / moat

Government ownership & standing : 75% government promoter (post-IPO before) and Navratna status gives policy, funding and preferential access advantages.

Specialist domain expertise in renewable project finance and strong relationships with Global financial lenders like World Bank, ADB, JICA, KfW & etc. lowers cost of funds and provides technical credit support.

High credit ratings on domestic instruments (AAA by CARE, easing bond funding and lower borrowing costs.

Barriers to entry: regulatory familiarity, government backing, track record (project monitoring, sector presence) and access to Lower cost these are not a simple task to Recreate for a newcomer.

5) Future Plans & Growth Prospects Of IREDA

Strategic initiatives

Continued large lending to solar, wind and hydro (FY25 53% of sanctions were in these areas.

equity raise program authored approvals to raise up to ₹5,000cr, intended to further strengthen equity base for faster growth.

Industry growth: India is aggressively scaling renewables, That creates a large addressable market for project lending.

Can IREDA outpace the industry? Yes Reasonable it’s specialized, government backed and focused on the segments that government policies support. Execution risks and funding cost shifts are the limiting factors. (source FY25 report)

6) Financial Health, Key Metrics And Trends

Last Five-year performance of IREDA

| Loan outstanding | ||||

| FY21 | FY22 | FY23 | FY24 | FY25 |

| 27,853.92 | 33,930.61 | 47,075.52 | 59,698.11 | 76,281.65 |

| Loan disbursements | |||||

| FY21 | FY22 | FY23 | FY24 | FY25 | |

| 8,828.35 | 16,070.82 | 21,639.21 | 25,089.04 | 30,167.87 | |

| Total Income | ||||

| FY21 | FY22 | FY23 | FY24 | FY25 |

| 2,657.74 | 2,874.17 | 3,483.05 | 4,965.29 | 6,754.78 |

| Profit After Tax (PAT) | ||

| FY23 | FY24 | FY25 |

| 1,252.23 | 1,698.34 | 1,698.60 |

| Net Worth | ||

| FY23 | FY24 | FY25 |

| 7,579.42 | 8,559.42 | 10,266.16 |

Cash flows / balance sheet strength

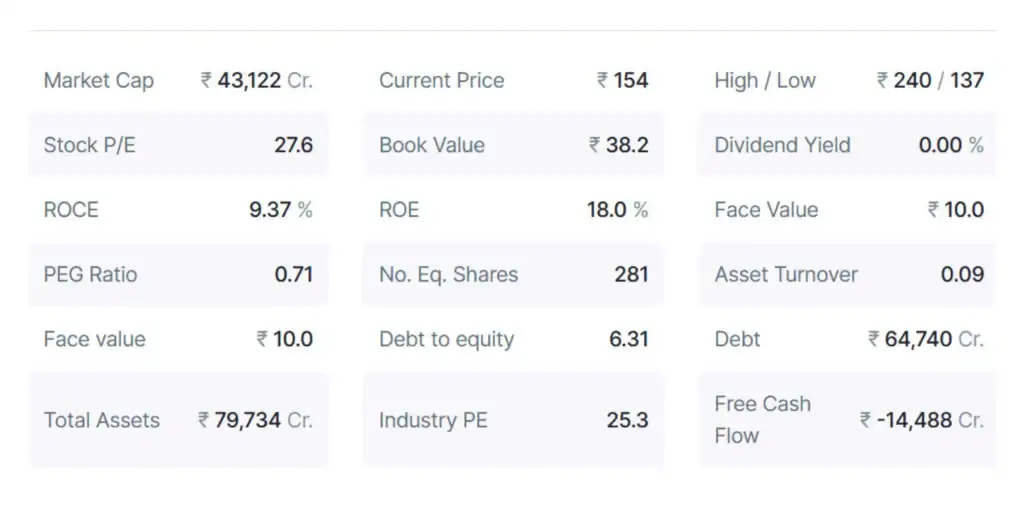

FY25 total assets ₹79,734cr and total equity ₹10,266cr. Borrowing mix increasingly includes bonds, subordinated and ECBs to match long tenor of lending. This has increased leverage or debt to equity 6.31 in FY25.

7) Valuation Of IREDA Share Price

We pulled live market numbers to compute standard ratios. Because market data moves

- present Market Price or ireda share price today ₹152.60 (16-09-25). was running at present.

- FY25 consolidated EPS : ₹6.32.

- Ireda Book value FY25: ₹38.20.

Calculated multiples (step-by-step guide)

Market cap

Ireda Shares × Price = 2,687,764,706 × ₹152.60.

Breakdown: 2,687,764,706 × 152 = 408,540,235,312

2,687,764,706 × 0.6 = 1,612,658,823.6

Sum = 408,540,235,312 + 1,612,658,823.6 = ₹410,152,894,135. , ₹41,015.29 crore.

How To Calculate Price To Earnings (P/E)

P/E = Price / EPS = 152.60 / 6.32.

Check: 6.32 × 24 = 151.68

remainder 152.60 − 151.68 = 0.92.

0.92 / 6.32 = 0.1455696

So P/E = 24 + 0.1455696… = 24.15. (rounded).

How To Calculate Price To Book (P/B)

P/B = Price / Book value per share = 152.60 / 38.20.

38.20 × 3 = 114.60;

38.20 × 4 = 152.80 (slightly above).

So 152.60/38.20 is 3.995

P/B = 4.0

Market comparison

Long standing central power capitalist trade at much lower P/E levels compare to REC, PFC have P/Es in the 5–6 range in recently. That makes IREDA’s P/E 24. significantly higher than others it is indicating the market is pricing higher growth expectations on the ireda share.

Interpretation

24 P/E is high when we camper traditional power finance companies like REC,PFC 5 and 6.

This reflects either

- market expects faster earnings growth for IREDA.

- a valuation premium for the renewables growth theme and relatively small public float after IPO/QIP. If growth disappoints than funding costs rise.

7) Pros & Cons of IREDA Share

Pros

- Market leader for public renewable project finance in India, strong pipeline and policy positive influence.

- Government backing (strategic advantage in access to low-cost funds.

- Improving profitability (PAT growth FY24 to FY25) while CRAR stayed comfortable due to equity and PDI raising.

Cons / Risks

- Leverage has increased (debt to equity 6.31) more sensitive to funding cost moves.

- Gross Non-Performing Assets increased slightly in FY25 and FY24. project finance can show lumpy stress. Monitor healing and resolution timelines.

- Valuation premium high expectations implant any execution miss could re-rate the

Ireda stock.

8) Five-year financial projections (Ireda Share Price Target 2025-2030)

We are projected FY26–FY30 revenue, PAT and EPS under three scenarios. we are predicted the Ireda Share Price Target 2025-2030.

Base case: revenue grows 15% p.a. (driven by continued disbursements & loan book growth), net profit margin held at 25.14%. Number of shares reduction assumed by FY25 shares 2,687,764,706.

usually exports will predict the share price target half of the revenue growth multiple present current market price

revenue growth 10% p.a and net margin 23%

revenue growth 20% p.a and net margin 26%

Base case

| FY | Revenue | PAT | EPS |

| FY26 | 7,768.00 | 1,952.87 | 7.27 |

| FY27 | 8,933.20 | 2,245.81 | 8.36 |

| FY28 | 10,273.18 | 2,582.68 | 9.61 |

| FY29 | 11,814.15 | 2,970.08 | 11.05 |

| FY30 | 13,586.28 | 3,415.59 | 12.71 |

| Conservative (10% growth, 23% margin) | |||

| FY | Revenue | PAT | EPS |

| FY26 | 7,430.26 | 1,708.96 | 6.36 |

| FY27 | 8,173.28 | 1,879.86 | 6.99 |

| FY28 | 8,990.60 | 2,067.84 | 7.69 |

| FY29 | 9,889.67 | 2,274.62 | 8.46 |

| FY30 | 10,878.64 | 2,502.09 | 9.31 |

Note: Margin stability are assumed a rise in finance cost for example higher rates, poor hedging or credit losses would lower PAT. stronger spreads or higher fee income would boost outcomes.

(Disclaimer – this information provided in the article is for only educational purposes. I am not SEBI Registered financial adviser. do not consider to this as investment suggestions or recommendation to buy or sell in shares . Please do your own research on this or approach the licensed financial advisor before making any investment decisions).

9) Market focus: Indian or US or Global?

Primary market: Indian IREDA’s lending in India only. sanction and operations are India centric it means majority of loan book is Indian projects only. It has started an IFSC subsidiary to extend foreign currency debt (ECB/IFSC financing) and building international funding lines (JICA, World Bank), but the borrower base and revenue are focused in India. recommend treating IREDA as an India market player on renewable project finance with global funding sources.

What Wre The Sources Base We Providing this deatils about IREDA Share

FY25 and FY24 Annual Reports and consolidated financials and all historical numbers, ratios, EPS, share count, loan book, CRAR, GNPA/NNPA, and management disclosures, consolidated P&L, balance shee and screener references used

Need to Know About Reliance Jio IPO

Conclusion

IREDA is a high quality government owned renewable lender with excellent growth prospects in India’s transition to renewable energy. However the current market multiple P/E is 24 seems to price healthy future earnings growth. If you want exposure to India renewable finance and comfortable with growth expectations and monitoring funding, IREDA is an attractive strategic holding but size your position mindful of valuation and possible reduction and watch quarterly asset quality trends. moreover approach the licensed financial advisor before investing.

Is IREDA a Government company?

IREDA full form is Indian Renewable Energy Development Agency Ltd. which is Government owned company

Is IREDA Undervalued or overvalued?

based on the recent PE it was overvalued when we consider the historical data of the company it was still in undervalued.